Amidst improving risk appetite ahead of crucial US-China trade discussions scheduled for later on Monday, gold prices remained largely unchanged.

Bullion prices saw substantial gains last week due to US economic instability and a weakening dollar, factors which favored safe-haven assets among traders.

Although stronger-than-anticipated nonfarm payrolls data provided some resistance, gold maintained its strength, remaining approximately $200 below record highs.

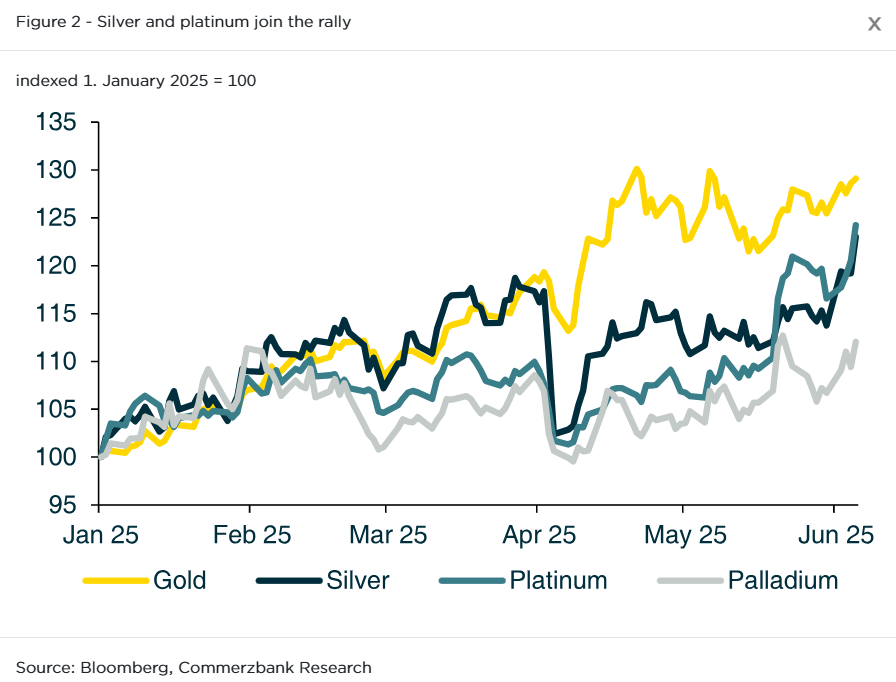

Silver prices had also climbed to a 13-year high last week, and are currently trading near those record levels.

Haresh Menghani, editor at FXStreet, said in a report:

The US Dollar (USD) struggles to capitalize on Friday’s gains, amid US fiscal concerns, and turns out to be a key factor that assists the bullion to reverse an intraday dip to sub–$3,300 levels, or a one-week low.

Platinum was a major outperformer, surging over 4% to a four-year high on expectations of tighter supplies.

At the time of writing, the most-active gold contract on COMEX was slightly down by 0.2% at $3,339.75 per ounce.

Platinum prices were up 4% at $1,215.70 an ounce.

Risk appetite improves

Discussions to ease the escalating trade tensions between the United States and China are scheduled for Monday in London, as senior officials from both nations convene.

This meeting comes amid a recent widening of the dispute, which now encompasses export restrictions on crucial goods and components, adding to the existing tariffs.

Recent positive US employment figures have shifted market predictions regarding Federal Reserve interest rate adjustments.

Investor anticipations for rate reductions have been revised, with the previous forecast of two cuts this year now reduced to a single expected cut in October.

Economic data showed on Friday that the US unemployment rate met expectations, holding steady at 4.2%.

After the release of the report, US President Donald Trump escalated his campaign against Fed Chair Jerome Powell, strongly advocating for a full percentage point rate reduction.

During times of political and economic instability, gold is often viewed as a secure investment. This safe-haven asset generally performs well when interest rates are low.

Platinum out of slumber

“It seems that the platinum price has awoken from its months of lethargy,” Carsten Fritsch, commodity analyst at Commerzbank AG, said in a recent note.

Until mid-May, the platinum price mostly fluctuated in a range between $900 and $1,000 per ounce. The $1,000 mark was only exceeded slightly and briefly, if at all.

On Monday, platinum prices hit a more than four-year high of $1,228.05 an ounce.

Following the release of updated supply and demand projections for the platinum market by the World Platinum Investment Council and Metals Focus, prices quickly rose last week.

While a significant platinum supply deficit is projected for the third consecutive year, a fact already known, both demand and supply are anticipated to decrease proportionally.

Consequently, this balance is unlikely to justify the observed substantial price surge, according to Fritsch.

Undervaluation in platinum market

“The strong price increase is apparently attributable to the significant undervaluation of platinum compared to gold and the resulting catch-up potential,” Fritsch said.

Gold prices soared to unprecedented heights recently, but platinum’s price remained stagnant for an extended period.

In April, platinum’s discount compared to gold surged to a record high, exceeding $2,400, Commerzbank said. Simultaneously, the gold-to-platinum price ratio also peaked at 3.6.

Gold’s high price may be pushing investors towards platinum as a more affordable option. There’s growing evidence that this shift is occurring.

“Whether the price increase will last remains to be seen. In the last two years, the price of platinum also rose significantly in May, but fell back again in the months that followed,” Fritsch noted.

A significant 70% of platinum demand comes from industrial sectors, particularly automotive. Consequently, an escalation of the trade conflict poses a risk of declining platinum prices.

Impending automotive production disruptions are being reported, stemming from a scarcity of rare earths and essential minerals.

Friitch added:

There are nevertheless upside risks to our year-end forecast of USD 1,000 per troy ounce.

The post Gold little changed as risk appetite improves; platinum scales over 4-year high appeared first on Invezz