China has imposed a ban on the export of seven rare earth elements without an export license, effective since April 4.

This action, based on recent history, suggests potential disruptions to global supply chains due to anticipated delays in the issuance of these necessary licenses, Commerzbank AG said in a report.

Germany sources a significant amount of its rare earth elements from China. While exports are expected to restart within a few months, potential supply disruptions could arise in the interim.

The affected elements that have been banned by China are samarium, gadolinium, terbium, dysprosium, lutetium, scandium and yttrium.

Rare earths encompass the 15 lanthanides along with scandium and yttrium. Gallium and antimony are also frequently included in this classification of special metals.

“Technically speaking, however, this is not correct,” Volkmar Baur, FX analyst at Commerzbank AG, said in a report.

“Rare earths are furthermore divided into light and heavy rare earths, with China having a near export monopoly on the latter.”

Previous controls slowed exports

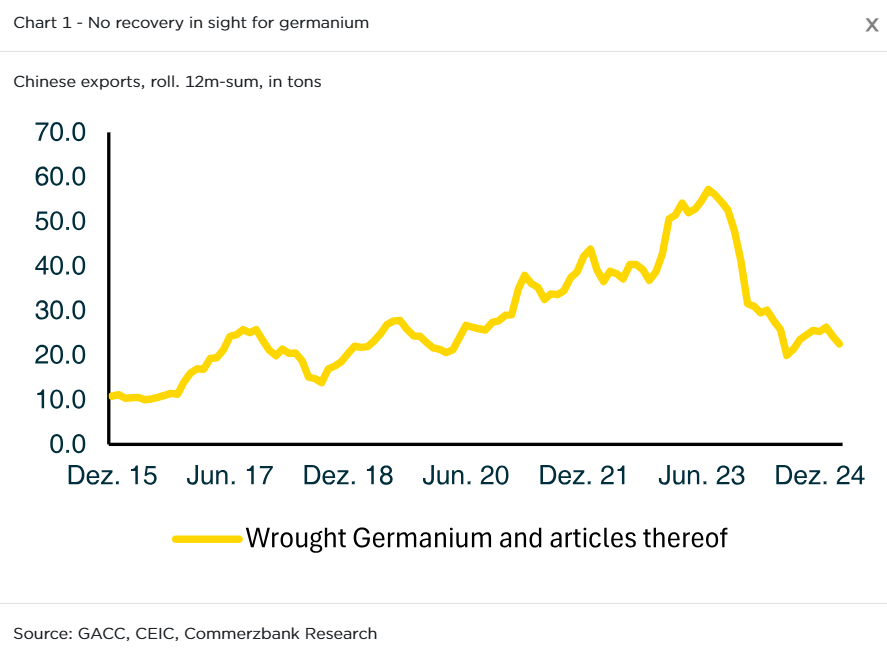

In July 2023, China implemented comparable licensing protocols for both gallium and germanium. Issuing the initial licenses required approximately two months.

As a result, no gallium or germanium was exported during that time.

Gallium exports took several months to recover afterward, and in the last year, germanium export volumes have stayed approximately 65% lower than their July 2023 levels.

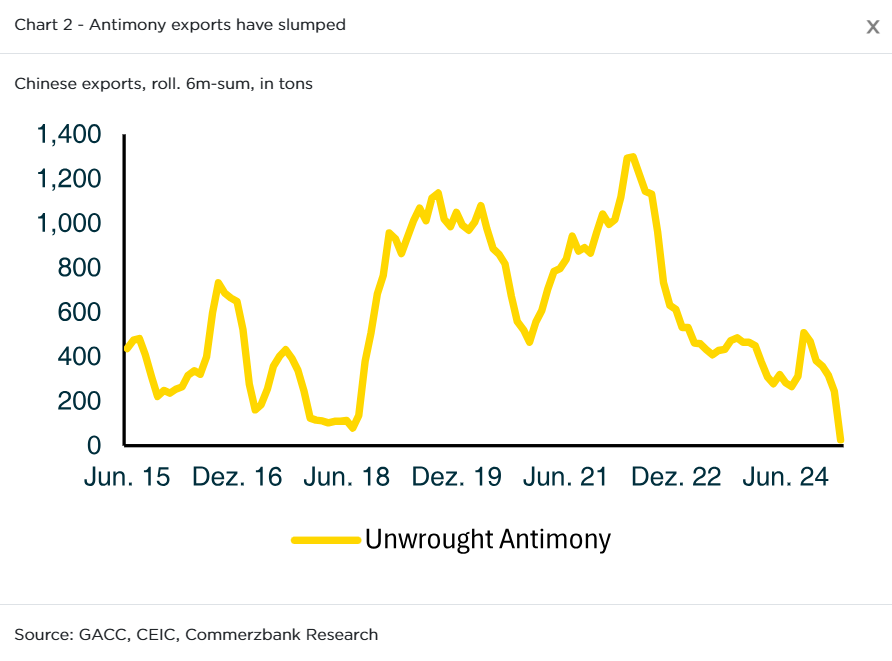

The introduction of licenses for antimony resulted in a halt of raw antimony exports for the initial three months.

Subsequently, in the following six months, exports declined by approximately 90% compared to the first half of 2024, according to a Commerzbank report.

Additionally, exports of antimony oxides and lead compounds containing antimony experienced a decrease exceeding 50%.

Complex licensing procedure

The complexity of the licensing procedure is to blame, according to Baur.

Exporters are required to complete six distinct documents, one of which is a customer profile.

The practice of requesting sensitive data has previously led some importers to cease importing from China.

Importers are also required to obtain permission from Chinese authorities before reselling the imported goods.

The Ministry of Commerce states that approvals typically take approximately 45 days after submission, though more complex cases may require a longer processing time.

Germany’s dependence on China

“Consequently, it is unlikely that these metals will be exported from China in April and May, and it may take longer for export volumes to return to previous levels,” Baur said in the Commerzbank report.

Germany heavily relies on China for rare earth imports, sourcing 65.5% of its total rare earth supply from China in 2024.

Baur said:

A further 23.2% came from Austria, with the remaining 5.6% coming from Estonia.

Europe only processes rare earths. Austria’s imports are likely re-exports, indicating that the actual reliance on Chinese rare earth supplies is probably higher than current figures suggest, according to Commerzbank.

China is the near-exclusive source for at least samarium, one of seven elements currently impacted.

There is also significant evidence suggesting that heavy rare earth elements—gadolinium, terbium, dysprosium, lutetium, and yttrium—are entirely sourced from China, Baur noted.

Challenge for German industries

Germany’s lack of recent stockpiling of the seven rare earth elements banned by China could cause supply problems for its automotive, wind turbine, and medical device industries due to potential delivery delays or significant supply cuts, according to Baur.

Permanent magnets rely heavily on samarium, terbium, and dysprosium in their production.

Export controls are also in place for products that include rare earth elements, such as magnets.

In limited situations, it’s possible to substitute the original magnets with neodymium magnets, as these alternatives are not under export restrictions, Baur said.

The post How China’s rare earth exports ban will affect global and Germany supply chains? appeared first on Invezz