There is no dearth of crude oil in the world right now. If anything, the world is floating in too much crude.

Fears of a significant oversupply in the market had been exacerbated by the Organization of the Petroleum Exporting Countries and allies’ recent decision to increase oil output by a surprisingly hefty amount in May.

Given the fact that global oil demand has remained subsided over the past year, with China importing less oil, the supply side risks seem far greater.

The ongoing trade tensions between the US and China have also raised concerns that demand in the Asian country may suffer more.

“Even without major downward revisions, the oversupply on the oil market is likely to be significantly higher than previously expected due to the unexpectedly strong increase in OPEC+ production from May,” Barbara Lambrecht, commodity analyst at Commerzbank AG, said.

This is likely to keep global oil prices subdued this year.

Commerzbank last week had revised downward their oil price forecasts.

At the end of 2025, the German bank sees Brent crude oil averaging $65 per barrel against the previous estimate of $75 a barrel.

Commerzbank expects a slight recovery in global prices in 2026 as demand stabilises and the expansion of non-OPEC oil production slows down.

The picture remains bleak this year in terms of global oversupply of oil.

Non-OPEC supply

OPEC’s forecasts showed that non-OPEC oil supply is likely to rise by 900,000 barrels per day in 2025 compared with the previous year.

“The main growth drivers are expected to be the US, Canada, Brazil and Argentina,” the cartel said in its monthly Oil Market Report on Monday.

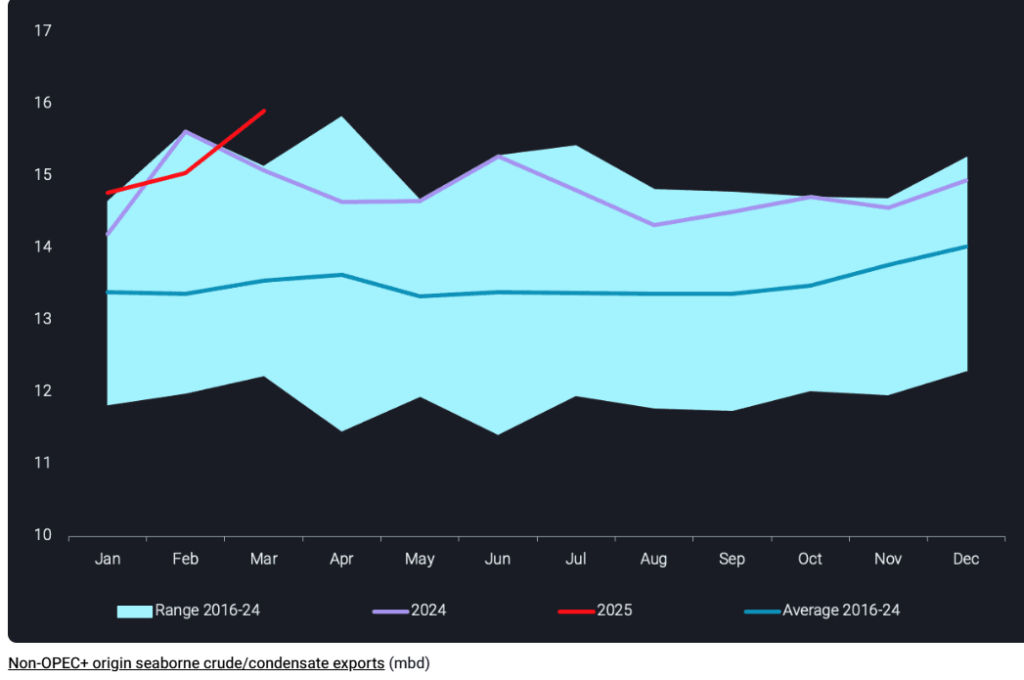

Seaborne exports in March from non-OPEC+ sources reached an all-time high, increasing 6% month-over-month, according to Vortexa’s data.

This growth reverses the stagnation trend observed for most of 2024.

The primary factors driving this surge are increased exports from Brazil, Colombia, and the UK in the Atlantic Basin, and West Coast Canada (TMX barrels) in the Pacific Basin.

Vortexa data showed that US exports have remained just below 4 million barrels per day in February and March 2025, and US supply growth, which drove non-OPEC+ supply increases in 2023, has slowed and even declined since early 2024.

Eastern world takes in supply

“For now, the supply growth has been largely digested by an import pull from the East,” Rohit Rathod, senior market analyst at Vortexa said in a report.

In early January, the US imposed substantial vessel-specific sanctions, causing concerns about the continued availability of sanctioned barrels from Russia, Iran, and Venezuela.

This triggered a wave of panic buying by India, China, and other Asian countries.

Rathod said:

These barrels have only started to arrive in Asia, while so far Russian and Iranian discharges continue largely unfazed by the sanction-related logistical challenges.

Furthermore, the unwinding of OPEC+ voluntary production cuts from April is likely to increase the availability of barrels.

Oil in tanks and tankers rise

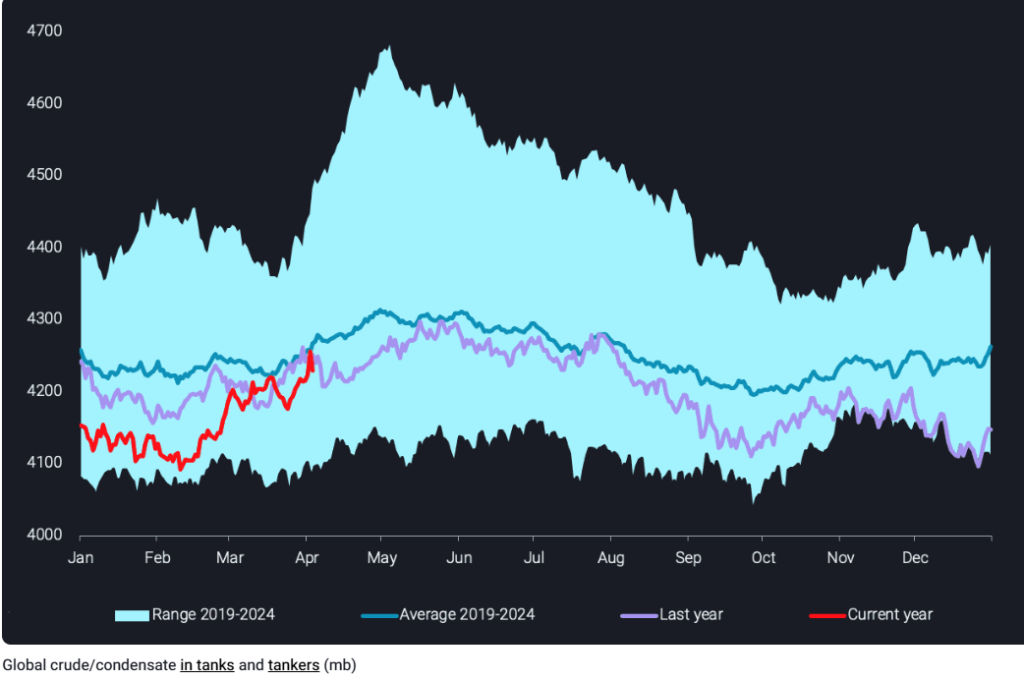

Onshore crude inventories have been building, despite the surge in global crude oil exports. This is attributed to spring maintenance and a slowdown in crude demand, caused by tighter refining margins in the Atlantic Basin.

“Along with stockbuilds, we also have increasing oil on water driven by long-haul flows from Atlantic Basin to Pacific Basin on the back of the strong East of Suez buying,” Rathod added.

The crude markets have lengthened by 120 million barrels since the middle of February, due to a combination of factors.

This has put downward pressure on crude oil prices, which were already shaken by market sentiment following US President Donald Trump’s announcement of reciprocal tariffs on April 2.

‘While crude in tanks and tankers already touches the seasonal average, this trend is likely to continue as more long-haul barrels arrive and current prices may well incentivise Chinese buyers to stockpile more crude,” Rathod further noted.

“It appears quite likely currently that the global onshore and offshore stockbuild will surpass average seasonal highs during Q2.”

Double whammy for prices

“A double whammy for crude oil prices came on April 3rd from the OPEC+ grouping, announcing an unwinding of their voluntary production cuts,” Rathod said.

The current strategy appears to be accelerating the phase-out of production cuts by increasing crude oil production by 411,000 barrels per day beginning in May.

Brent crude oil prices have recently fallen below $65 per barrel as a result of this unexpected increase in supply.

OPEC+ has indicated that production increases may be halted or even reversed depending on market conditions.

But, for now the higher than expected reduction in Saudi OSPs could indicate a commitment towards unwinding production cuts and gaining market share in Asia, increasing the pressure on non-compliant OPEC+ producers.

The post Crude oil may not have much upside potential as oversupply grips market appeared first on Invezz